Present

Facts for Kids

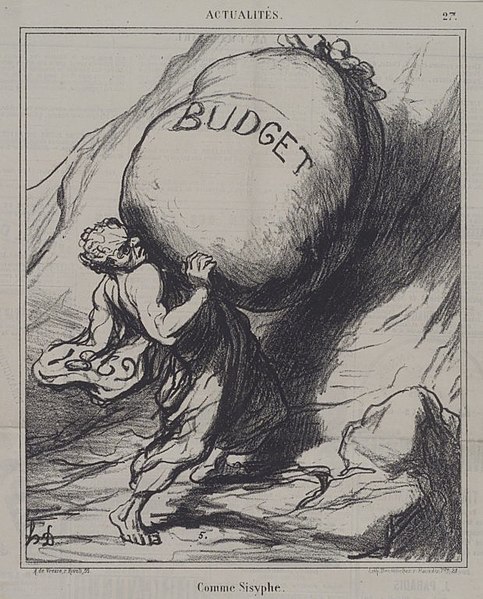

A budget is a plan that tells you how to use your money wisely over time, like a map for spending and saving.

Explore the internet with AstroSafe

Search safely, manage screen time, and remove ads and inappropriate content with the AstroSafe Browser.

Download

Inside this Article

Household

Addition

Saving

People

Month

Bank

Good

Don

Are

Did you know?

🗺️ Budgets are like magic maps that help people plan how to spend money wisely.

💰 A budget helps you decide whether to save or spend your money.

🎉 There are different types of budgets, such as fixed, variable, and zero-based budgets.

🔮 Creating a budget helps you control your money rather than letting money control you.

🤑 A budget lets you save for bigger purchases, like that cool bike you've always wanted.

📸 A balance sheet shows what you own and owe at a specific time.

💸 Estimated expenditures are the spending you expect to happen.

🎈 Knowing your estimated receipts helps you plan how to spend or save your money.

🍰 Creating a budget can be fun, just like following a special recipe!

😅 Remember, everyone makes budgeting mistakes, so learn from them and keep trying!

Show Less

Become a Creator with DIY.org

A safe online space featuring over 5,000 challenges to create, explore and learn in.

Learn more

Overview

Budgets are like magic maps! 🗺

️ They help people plan how to spend their money wisely. Imagine you have $10 🤑 for a week. A budget helps you decide if you want to save for a new toy 🎁, buy candy 🍭, or go to the movies 🎬. Instead of spending all your money at once, a budget lets you choose how much to spend or save. Many families and businesses use budgets to make sure they have enough money for what they need and want. Learning to create a budget can be super fun and will help you manage money! 💰

️ They help people plan how to spend their money wisely. Imagine you have $10 🤑 for a week. A budget helps you decide if you want to save for a new toy 🎁, buy candy 🍭, or go to the movies 🎬. Instead of spending all your money at once, a budget lets you choose how much to spend or save. Many families and businesses use budgets to make sure they have enough money for what they need and want. Learning to create a budget can be super fun and will help you manage money! 💰

Read Less

Types of Budgets

There are several types of budgets that many people use! One popular type is a "fixed budget," where you plan the same amount every month. 📅

Another type is a "variable budget," where expenses change from month to month, like holidays or special events. 🎉

There’s also a "zero-based budget," where you plan for every single dollar you earn! This means you decide where every dollar goes! 🤑

Families and businesses use these types of budgets to stay on top of their money. Which type of budget do you think would work best for you? 🤔

Another type is a "variable budget," where expenses change from month to month, like holidays or special events. 🎉

There’s also a "zero-based budget," where you plan for every single dollar you earn! This means you decide where every dollar goes! 🤑

Families and businesses use these types of budgets to stay on top of their money. Which type of budget do you think would work best for you? 🤔

Read Less

Definition of a Budget

A budget is a plan that tells you how to use your money over a certain time. ⏰

It usually covers how much money you will earn and spend. For example, if you get an allowance every week, a budget helps you decide how to use that allowance. You may decide to save some and spend the rest on things you enjoy, like snacks or toys! 🎲✨ Budgets can be for big things, like household expenses, or small things, like your weekly treats. Understanding how to budget means learning how to be responsible with money! 💡

It usually covers how much money you will earn and spend. For example, if you get an allowance every week, a budget helps you decide how to use that allowance. You may decide to save some and spend the rest on things you enjoy, like snacks or toys! 🎲✨ Budgets can be for big things, like household expenses, or small things, like your weekly treats. Understanding how to budget means learning how to be responsible with money! 💡

Read Less

Importance of a Budget

Why is making a budget so important? Well, it helps you control your money instead of letting money control you! 🔮

With a budget, you can save for bigger purchases and avoid spending too much at once. Saving money can help you buy something special in the future, like that cool bike 🏍️ you’ve always wanted! A budget also helps families plan for things they need, like groceries 🍎 or paying bills. Learning to budget means you can also manage your birthday money 🎂 wisely, so it's always exciting when you finally buy something new!

With a budget, you can save for bigger purchases and avoid spending too much at once. Saving money can help you buy something special in the future, like that cool bike 🏍️ you’ve always wanted! A budget also helps families plan for things they need, like groceries 🍎 or paying bills. Learning to budget means you can also manage your birthday money 🎂 wisely, so it's always exciting when you finally buy something new!

Read Less

Common Budgeting Mistakes

Everyone makes mistakes, even with budgets! 😅

A common mistake is forgetting to plan for surprises, like buying a last-minute gift 🎁. Another mistake is not keeping track of little purchases, like snacks or toys. Every small cost adds up! 🥳

Some people also forget to review their budgets regularly, which means they might miss necessary changes. If you find your budget is not working, that’s okay! Learn from it and adjust as needed. Mistakes can teach you valuable lessons, and with practice, you’ll become a budgeting pro! 💪

Keep trying!

A common mistake is forgetting to plan for surprises, like buying a last-minute gift 🎁. Another mistake is not keeping track of little purchases, like snacks or toys. Every small cost adds up! 🥳

Some people also forget to review their budgets regularly, which means they might miss necessary changes. If you find your budget is not working, that’s okay! Learn from it and adjust as needed. Mistakes can teach you valuable lessons, and with practice, you’ll become a budgeting pro! 💪

Keep trying!

Read Less

Budgeting Process and Steps

Creating a budget is like making a special recipe! 🍰

Here are some steps: First, write down how much money you have coming in 🤑, like your allowance or gifts. Next, list your expected spending, like snacks or toys. Then, compare your income and expenses! If you have more income than spending, yay! 🎉

If not, you'll need to adjust your spending to make sure you don’t run out of money. You can plan for savings too! Lastly, review your budget every month to make sure it’s working well. It’s a fun way to learn how to manage your money!

Here are some steps: First, write down how much money you have coming in 🤑, like your allowance or gifts. Next, list your expected spending, like snacks or toys. Then, compare your income and expenses! If you have more income than spending, yay! 🎉

If not, you'll need to adjust your spending to make sure you don’t run out of money. You can plan for savings too! Lastly, review your budget every month to make sure it’s working well. It’s a fun way to learn how to manage your money!

Read Less

Components of a Balance Sheet

A balance sheet is like a snapshot 📸 of what you own and what you owe at a specific time. The main parts are assets, liabilities, and equity. Assets are things you own, like your bike 🚲 or savings in the bank. Liabilities are what you owe, like if you borrowed money from a friend 💵. Equity is what’s left after you subtract what you owe from what you own. For example, if you have $30 and owe $10, your equity is $20! Understanding a balance sheet helps you see how financially healthy you are! 🏦

Read Less

Tools and Software for Budgeting

Using tools and software can make budgeting even easier! You can use simple apps on a tablet or computer 💻 to track your money. Some colorful charts 📊 can show how much you’re earning and spending. In addition, you can find printable budget sheets or spreadsheets that help you organize your expenses. There are even fun kids’ apps that help you learn about managing money! 🎵

Experiment with different tools to find what works best for you and your family. Great budgeting tools can help keep you ahead of your spending!

Experiment with different tools to find what works best for you and your family. Great budgeting tools can help keep you ahead of your spending!

Read Less

Understanding Estimated Receipts

Estimated receipts are predictions of the money you are likely to earn. 🎉

For example, if you think you'll earn $5 from chores and $2 from your birthday money, your estimated receipts for the month would be $7! 📅

Knowing your estimated receipts helps you plan how you can spend or save your money. It's like guessing how much candy 🍭 your friend will give you and planning how to share it! Estimated receipts can be based on previous experiences, like how much you earned last month. The more accurate your estimate, the better your budget can be!

For example, if you think you'll earn $5 from chores and $2 from your birthday money, your estimated receipts for the month would be $7! 📅

Knowing your estimated receipts helps you plan how you can spend or save your money. It's like guessing how much candy 🍭 your friend will give you and planning how to share it! Estimated receipts can be based on previous experiences, like how much you earned last month. The more accurate your estimate, the better your budget can be!

Read Less

Variances and Budget Adjustments

Sometimes, things don't go as planned, and that’s okay! 🌈

Variances happen when your actual spending is different from what you budgeted. For example, if you expected to spend $5 on candy but spent $7 instead, we have a variance! 🤷

♂️ It’s important to look at these variances and make adjustments. You might want to spend less next month or find ways to earn more money! By adapting your budget, you’ll learn how to be flexible and responsible. This helps you keep on track and reach your money goals! 🥇

Variances happen when your actual spending is different from what you budgeted. For example, if you expected to spend $5 on candy but spent $7 instead, we have a variance! 🤷

♂️ It’s important to look at these variances and make adjustments. You might want to spend less next month or find ways to earn more money! By adapting your budget, you’ll learn how to be flexible and responsible. This helps you keep on track and reach your money goals! 🥇

Read Less

Understanding Estimated Expenditures

Estimated expenditures are the costs you expect to spend. 💸

For instance, if you plan to spend $3 on snacks and $4 on a book 📚 this week, your total estimated expenditures for the week are $7! Knowing these amounts can help you see if you have enough money from your estimated receipts. A good way to understand your expenditures is to keep a list of what you need and how much it costs. This way, you won't run out of money when you want something fun! 🎈

It’s exciting to know where your money goes!

For instance, if you plan to spend $3 on snacks and $4 on a book 📚 this week, your total estimated expenditures for the week are $7! Knowing these amounts can help you see if you have enough money from your estimated receipts. A good way to understand your expenditures is to keep a list of what you need and how much it costs. This way, you won't run out of money when you want something fun! 🎈

It’s exciting to know where your money goes!

Read Less

Try your luck with the Budget Quiz.

Try this Budget quiz and see how many you score!

Q1

Question 1 of 10

Next

Explore More